HL co uk is the main website where you will find Hargreaves Lansdown services and products they offer. They have a wide range of services that pertain to investments.

They have the reputation to back up their prominence too; they have been in the stock broking business for thirty years weathering the financial turmoil at that time and still manage to grow by leaps and bounds.

HL co uk: Review

They have 58.8 billion Pounds of assets under management which is an impressive fit to achieve and above that they have gained the confidence of many people who have become long-term clients, they have 783,000 clients.

This goes to show that their clients are getting their investment’s worth and that is why that number will continue to grow over the years. Their list of products is extensive, but many clients have opened share dealing accounts with them because of their prices and low-cost charges attached to the trades they make as traders.

HL co uk has managed to grow its reputation over the years, and this has made it part of the highly acclaimed FTSE 100 list of companies.

The unique aspect about being listed in these group of companies is that most of the companies in the list are multi-national companies while Hargreaves Lansdown is a fully 100% United-Kingdom-based company with 950 employees from the United Kingdom.

They have managed to create a huge number of products for their clients, and they have categorized them into sections that are easy to understand and navigate through.

They are purposed to help their clients achieve their investment goals, and that is why they have a dedicated team of customer service agents who average 15.4 seconds for any call from a client to be answered.

This has been validated by their award from Investor Chronicles and FT for the Best stock Broker for Customer Service for the year 2015. They have won other awards for their SIPP, ISA, mobile trading platform from Money Week Magazine over the years past.

This goes to show they are a reputable broker and to add to this claim they are regulated by the Financial Conduct Authority under the reference number 149970.

HL co uk: Shares

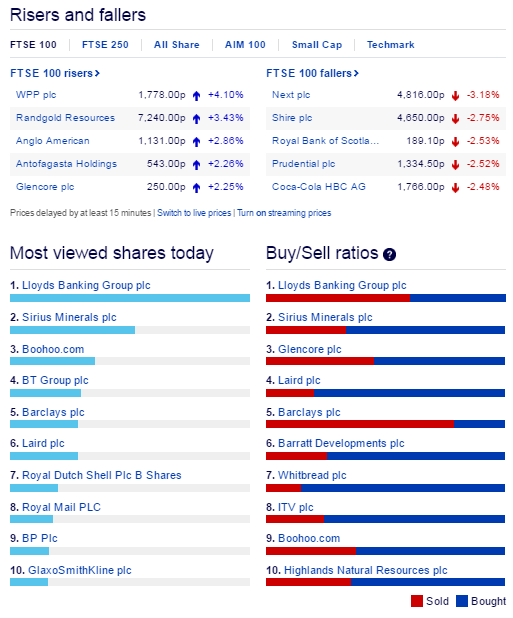

HL co uk has a wide range of investment products they have on offer. The most traded or dealt investment vehicle is the shares. Most clients deal shares from Hargreaves Lansdown because they have a wide range of shares from different markets from around the world.

Their shares are from the local exchanges and those from the United States, United Kingdom, Canada and other European countries. This gives the wide client range of options, and thus a client can build a very profitable portfolio from the long list of shares available.

The website is well structured in a way they can get to the share dealing page and get all the information they need.

HL co uk realized that their clients especially the active traders or investors had a problem because they did not have access to the live share prices and this was a major setback since they had to keep on refreshing their web pages to get the price now which was still lagging.

So, they developed the feature called the live share price that is given free to all their clients as long as they had opened an account with them.

The account could either be a fund and share account or a stock and share ISA account. The live share price feature has some advantages such as it no longer have 15-minute delays, they get up to second share price throughout the day for most of the United Kingdom shares.

The client does need to refresh the page consistently to get the updated share prices. This service is completely free as long you have an account, and the service is also available on the Apple store as a mobile application.

There are few steps one requires opening a share dealing account. First, you visit their website go to the share prices and stock markets and when it opens to your left there is the share dealing service option and when that opens you can easily see the open account steps outlined clearly.

HL co uk: Share Prices

HL co uk share prices are very affordable compared to other brokers offering the same services; their price is quite effective and the cost associated are quite low too. Especially for traders who use the online and mobile platform to trade get the best price per deal handled.

The price per deal is mostly determined by the number of deals made in the previous year. 11.95 Pounds is the amount paid by the trader who traded less than 10 deals in the previous year.

For the more active investor who dealt 10-19 deals in the previous year, get to pay 8.95 Pounds per deal which is a lot cheaper. The most active traders get the best discount; any deals above 20 in the previous year warrant the trader to pay 5.95 Pounds per deal.

These low charges encourage the traders to make more trades and thus get a better offer for their trades. The investors who deal via the phone and post deals through it are charged 1% for their deal which is a minimum of 20 Pounds and a maximum of 50 Pounds.

Investors who want to reinvest their dividends also have a 1% cost which can be 1 Pound or a maximum of 10 Pounds. For the regular equity savings they get to pay 1.50 Pounds per stock per month, and if they are dealing the stocks in FTSE 350, the cost per share goes higher.

There are annual management fees for investors who have managed accounts; fund and share accounts do not attract any charges, ISA accounts have a 0.45% a year or a maximum of 45 Pounds, SIPP accounts have 0.45% charge or 200 Pounds maximum.

Cash accounts have no charges and funds have charges structured based on the amount of money invested in the fund.